As a player in the burgeoning and brand spanking new FinTech industry, fintech marketers need to have innovation and disruption at their heart while utilising the latest fintech marketing techniques to effectively promote their products and services.

Well, if you’re reading this, then you’re in good company. Inbound marketing has emerged to innovatively disrupt the marketing industry as much as FinTech has financial services.

> Read more to learn about fintech marketing

It is only natural, therefore, that the two should be wed, and together produce a litter of FinTech marketing hacks that will bring untold success and new customers to your door.

FinTech and Inbound (Sitting in a Tree)

Fintech companies and their financial services have been disrupted by the digital revolution, which was further accelerated by the economic downturn at the end of the last decade. To stay ahead of the game, these companies can benefit from adopting a customer-centric approach and leveraging social media marketing to engage with their target audience. Additionally, influencer marketing can be a powerful tool for fintech companies to increase brand awareness and credibility among their audience.

And here is the first parallel of what will undoubtedly prove to be a blooming romance – much as consumer demand for digital is driving the FinTech industry, so too is it shaping digital marketing.

Inbound marketing is now here to give your target audience what they want (information), when they want it (at times convenient for them), and where they want it (online).

Information. Convenience. The internet. Three vital things that FinTech innovators also build their services around.

We don't want to appear too forward, but already inbound and FinTech look like they could be a match made in heaven that will improve your company's trajectory positively and help you get great leads.

And there's more. Inbound marketing is an effective strategy for fintech companies to appeal to millennials, who are a key target audience. To achieve this, it is important to focus on user experience and building long-term customer relationships. Leveraging social media platforms can also be beneficial for fintech marketing efforts, as they offer a way to reach and engage with younger demographics. Consider partnering with a fintech marketing agency to optimize your marketing campaigns on these platforms and ensure they are effectively targeting your desired audience.

So, is it a date?

Well, in case you're still playing hard-to-get, let us elaborate further on some of these Financial technology marketing hacks that will prove that FinTech and inbound are made for each other.

5 FinTech Marketing Hacks that Bring New Customers to You

1. The Power of Education

Building trust and credibility is imperative to any service in the financial industry – sensitive data concerning hard-earned dosh will not be entrusted to any organisation lightly.

But, even with consumer demand dictating that more and more emphasis be placed on digital solutions, FinTech nonetheless remains a relatively new sector, and any players within the space must build their credibility up from the bottom.

Inbound marketing is your key to success.

No matter if you’ve got a FinTech product that’s geared toward the realms of B2B or are selling your services directly to online consumers, the people that are searching for a solution like yours want to know that you are trustworthy and credible.

More than that – they want to know exactly how your product or service will benefit them.

Still more – they want to know what your processes are for keeping their data secure.

In short, they want to know everything – and perhaps the most vital FinTech marketing hack there is is to ensure that the relevant information is there and easily discoverable to provide your prospects with everything they need to know.

This, indeed, forms the very core of inbound marketing. Through strategic creation and distribution of informative and useful content, you are able to educate your potential customers both on the powers and security your alternative financial solution, as well as your expertise in the field.

Educate. Inspire. Convert. That’s your most crucial results-driven three-step FinTech marketing hack right there.

[inline-form]6 FinTech Marketing Tips Ebook[inline-form]

2. The Millennial Focus

We’re willing to make a bet that millennials will form at least part of your target demographic. Even if this cohort doesn’t constitute as your primary target, when it comes to digital innovations, you surely can’t be ignoring the Generation Y market.

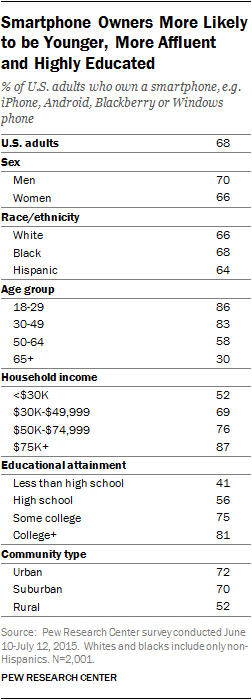

Pew Research reveals that 86% of those aged between 18 and 29 have a smartphone (with 78% of them spending more than 2 hours each day using a smart device), a figure that drops only to 83% in the 30-49 age bracket. All told, 68% of adults now own a smartphone.

Your FinTech solution may involve a smartphone app – it may not. But, either way, the likelihood of the mobile discovery of your solution is high – or at least that needs to be your aim.

Inbound marketing will facilitate this in no uncertain terms.

A key part of inbound marketing strategies involves putting the right content in the right places at the right times to ensure that your target audiences are furnished with the most valuable information on the devices that they are most likely to be using.

For millennials – and indeed 68% of all adults – this means mobile, and the creation of mobile-optimised content through which your all-important education can be delivered.

Just 23% of millennials say that they feel fully engaged with their bank – what better chance is there to fill this massive void by engaging the unengaged through the delivery of great content right there on the devices that they love most?

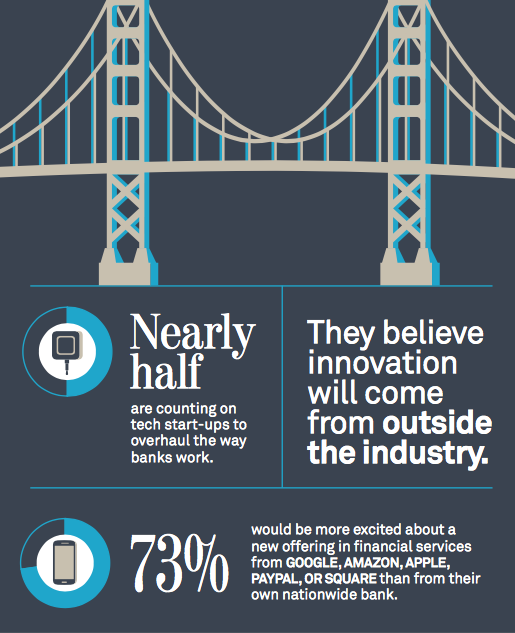

The Millennials Disruption Index – a three-year study that surveyed over 10,000 millennials – found that 73% would be more excited about a new offering in financial services from Google, Amazon, Apple, PayPal, or Square than from their own bank.

Why? Because these are the brands that millennials are most engaged with day in, day out.

But why leave all the business go to these big players? If you’re in FinTech, then you need a marketing strategy that speaks to this generation in its own language – just like your solution does. With inbound marketing, you can seize this opportunity, and with the right approach and mobile-focus, you’ll be able to capture more customers not just from the banks, but the Apples and Googles and PayPals of this world as well.

3. Building Long-term Customer Relationships

All new or traditional financial institutions need customers for business growth, and for FinTech startups looking to first break even before profits start being turned, then acquiring customers that will stick with you for the long-term is a must.

The FinTech marketing hack we are looking at here, therefore, involves giving your customers a reason to fall in love not just with your solution, but your brand as a whole.

Inbound marketing strategies are designed for just that purpose. Keeping your customers engaged for the long haul is no mean feat. It requires the establishment of an emotional connection, and this is achieved through storytelling.

As your FinTech company grows, it’s important that you share the experience with your customers. This can be done through content – blogs, infographics, videos, etc. But, more importantly and more effectively, this should also be done by making your loyal customers a part of that story.

How is this done? Well, first, you will need to be constantly tracking customer behaviour, analysing their data to find out exactly how people are using your service and what they are getting out of it. With this information, you will be able to address their specific pain-points and improve your service around your discoveries.

In turn, you should also be reaching out to them on social media (another favourite millennial haunt). What are your customers saying about your brand and your solution? Software will of course be your guiding light in this regard, and a platform such as HubSpot will provide you with the necessary information to identify where the most important discussions surrounding your brand are being held.

From here, you will be armed with the goods you need to execute the next of our FinTech marketing hacks.

4. Custom Content

Content marketing embodies one of the most important elements of inbound marketing for fintech technology, and the more customised you can make it, the better.

Your customers will have come to you because your solution speaks to them in a way that no one else’s does. The task at hand now is to make sure that it stays this way.

By listening to what people say on social media– and indeed, whether they are already customers of yours or not, you need to be keeping your ears open – you can craft and deliver content in direct response to their wants and needs.

What questions do people have – not just about your brand and/or your solution, but about the evolution of the financial services industry as a whole?

Through the creation of quality content by your fintech marketing team that answers these questions, you can simultaneously demonstrate exactly where your FinTech company fits into the equation, and subsequently position your brand as a true industry authority with a solution that ticks as many boxes as possible.

Through such an inbound content marketing strategy, you can see that the goal is not just to increase individual sales, but to increase the level of talk surrounding your brand, and convincing more of your existing customers to stick with you and come back for more.

5. Transparency

One of the greatest ways to ensure trust is built is to provide transparency in all your operations.

In the FinTech sector, transparency has a particularly important role. People have grown to have an almost instinctual distrust of the financial industry, and of the banks in particular. The only way to combat this is to show that your FinTech company is different and has nothing to hide.

The FinTech marketing hack here, therefore, is to make it as easy as possible for people to access information about your brand, your history, your product, your service, and your processes.

This, again, involves the creation of content that provides this information. It means predicting what questions your prospects may have, and ensuring that the answers are there and easily discoverable when they go looking for them.

This, indeed, is the heart of inbound marketing – a heart that’s shared with all FinTechs looking to gain a competitive edge in the make-or-break digital space.

Over to You

Is love in the air?

We believe it is. Fintech app marketers can benefit from utilizing various fintech marketing strategies and tactics to engage their target audience through inbound marketing. As customers and prospects reside online, a digital-focused approach can be highly effective for fintech marketing campaigns.

To learn more about building a customised fintech marketing strategy, book a free consultation today by filling out the form on the sidebar.